As I’ve already reported, now-key members of the new Fukuda Cabinet have been gearing up to take a pass for a year or more before hitting the public for an increase in the consumption tax rate to finance the 2.3-trillion yen hike in subsidies for public pension payouts. On Saturday, the newly-inaugurated Finance Minister Bunmei Ibuki gave a press conference where he made it clear that he intended to draw on the so-called “buried treasures”, the trillions of yen the government had stashed away in special accounts and state-controlled institutions. Against that kind of money, what are a couple of trillion one way or another, no?

Well, not quite. You see, the government has already been there, done that. In spades. Which points to a problem that dwarfs the bridge over the gap in the pension system. Let me explain.

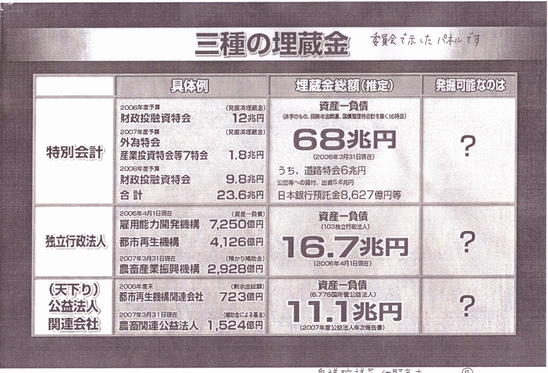

Maizokin, or “buried treasures”, is the term used initially by the DPJ and picked up by expansionist LDP politicians to describe assets tucked away in the myriad special accounts, state-owned corporations and the like that they want to use to eliminate some of that huge public debt overhang or to spend on other undertakings that they deem worthy. The amount of said treasures is subject to dispute, but the DPJ’s favorite figure for the total value of those “buried treasures” is 96 trillion. However, this figure is merely a rough approximation of the maximum upside, as a cursory look at the following panel that Goshi Hosono used in a Lower House Budget Committee session on January 28 shows:

The 96 trillion is the sum of the book value of the net assets in all the special accounts (68 trillion), incorporated administrative agencies (16.7 trillion) and government-affiliated public interest entities and corporations (11.1 trillion; Mr. Hosono identifies them as places for amakudari, i.e. golden parachutes for the bureaucracy). The assets mainly take the form of cash, other securities (mainly but not exclusively U.S. Treasury bills), loans outstanding, real estate and other fixed assets, and equity holdings.

One problem in disinterring these “buried treasures” is that much if not most of the loans outstanding have been extended at below market rates and would have to be marked down—some, like concessional loans substantially—in the event of their liquidation or other means to monetize the assets. * Likewise problematic are the real estate (including roads and bridges) held by many of those incorporated administrative agencies, whose current market value must have fallen substantially since the end of the bubble economy. Any fire sale would further diminish the value of those relatively illiquid assets. This means that the “equity” that the government holds figuratively in the form of reserves in the special accounts or literally as paid-in capital in the incorporated administrative agencies cannot be taken at face value.

These are the main concerns that lead me to believe that there is a great danger that the ultimate net value of the “buried treasures” will be only a fraction of the DPJ’s initial bid. In fact, Mr. Hosono’s panel intimates as much in the last column, where there is a question mark for every category under the heading “what we can recover”. It is evident that for the near future, it is highly imprudent to hope to recover anything other than cash at hand.

Now, the LDP enthusiasts’ version:

Last December, in a magazine article, Hidenao Nakagawa was quoted as identifying the following money as of the end of FY2007 as “buried treasure”:

—19.6 trillion yen: cash reserves in the Fiscal Investment and Loan Special Account (FILP-SA)

—19.3 trillion yen: cash reserves in the Foreign Exchange Special Account (FE-SA)

Mr. Nakagawa said that the reserves in the public pension and other accounts didn’t count as “buried treasures” since they would eventually be drawn down to fill the future gap between growing payouts and dwindling premiums inevitable in an aging society. (Mr., Hosono is careful to exclude them in coming up with the 96 figure for the DPJ.) But he did not list any of the other assets directly or indirectly belonging to the government. So far so good.

But that was then. By the end of this fiscal year, other things being equal (they never are), Mr. Nakagawa’s 40 trillion stash will be reduced to 30 trillion. You see, the FY2008 General Budget already includes a 9.8 trillion yen transfer from the FILP-SA. That’s right, MOF is already digging up half the “buried treasure” in the FILP-SA, since without the cash infusion, new bond issues in FY2008 would soar to 35.2 trillion yen. That’s not the end of it. There is a good likelihood that the economy is going into a downturn. If that happens, corporate tax revenues, which has been the bright spot in public finance, will take a tumble, leaving MOF with no choice for the FY2009 General Budget but to scoop out the remaining 9.8 trillion yen in the FILP-SA reserves, dip into FE-SA reserves, let government bond issues soar, or do a combination of some or all of the above. If MOF Minister Ibuki (and new Economy Czar Kaoru Yosano and Chief Cabinet Secretary Nobutaka Machimura) are to be believed, 2.3 trillion yen of the “buried treasures” are all but officially earmarked for raising the subsidy to the public pension system from 1/3to 1/2 of the funds necessary to meet basic pension payments. (The remaining half will continue to be funded by pension premiums.) Assuming both tax revenues and General Budget expenditures as well as the sum of all other budgetary constraints remain constant, this means that the government will have to cash out the remaining FILP-SA reserves and withdraw 2.3 trillion from FE-SA reserves in FY2009, and take a further 12.3 trillion from FE-SA in FY2010. In FY2011, that will leave the FILP-SA with no reserves at all and FE-SA with less than 5 trillion.

Of course other things are not equal. For instance, MOF has returned a healthy surplus in the FE-SA in recent years and there are no signs that its streak of wins is coming to an end. Still, if MOF is caught in a horrible dollar freefall, it might have to take a huge markdown on its dollar-denominated holdings, i.e. the bulk of its 900 trillion yen and upwards in foreign-currency-denominated holdings.

That, my friends, is what I think that we can look forward to. I don’t know enough about how the budgets really work to be sure. For all I know, this could be full of errors and omissions. (Yes, I am aware that I haven’t mentioned the transfers to the Government Bonds Retirement Special Account…) But what I’ve seen so far suggests that the convergence between the LDP and DPJ with regard to the “buried treasures” is by no means a political consensus to be welcomed.

* I assume that these financial assets are in principle not marked to market but accounted for by the cost of acquisition, the big exception being foreign currency-denominated assets, which are assessed under prevailing currency rates.

If you are interested in budgetary issues but don’t know where to start, this MOF webpage is a good place to start. If you can read Japanese. For special accounts, look here. And a fun site. All in Japanese though.

2 comments:

Hey

Great blog… I recently bought my first house and I used blogs and websites like this one to find out more information on real estate in general. In fact in my search I found the guys at http://www.homeinspectionspecialist.com and they inspected my house. Not only their inspection was affordable but also detail and comprehensive. Anyways, thanks again and I look forward to all the updates.

Jessica

I know why the "anonymous" comment got posted here. [strike]Home Inspection Specialist[/strike]It thinks that this is a legal blog. It all goes back to my post on Bull-dog Sauce and Steel Partners. Too bad [strike]Home Inspection Specialist[/strike]it didn't bother to actually read my blog.

Post a Comment